Child Care Investments at the State or Federal Level?

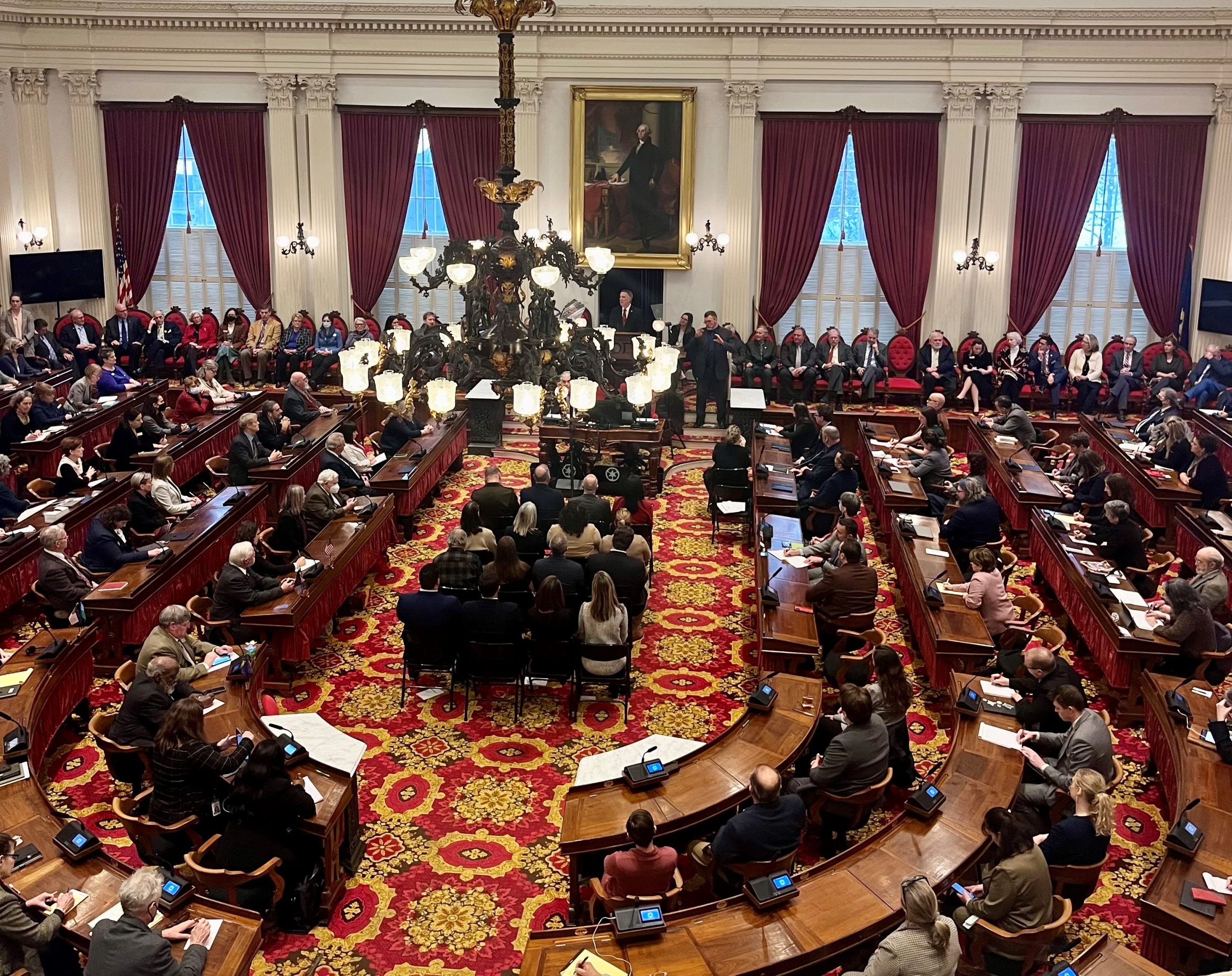

Last week, the House nearly unanimously passed child care legislation that would provide immediate investments to support Vermont’s economy and set goals over the next several years to achieve affordable access to high-quality child care. H.171, now under review in the Senate, calls for the following child care investments:

- $5.5 million to increase funding for Vermont’s Child Care Financial Assistance Program (CCFAP), implementing the third year of a five-year plan, enabling expanded eligibility for child care financial support.

- $2.5 million in investments to support and strengthen Vermont’s early childhood education workforce through student loan repayment and scholarship programs.

The bill also charges experts to convene two studies to examine and identify strategies for effective governance and sustainable funding for a truly affordable, high-quality child care system for Vermonters. Let’s Grow Kids, a child care advocacy organization, led efforts to advance this legislation, partnering with families, early childhood education, and businesses.

There is common agreement about the need, but less attention has been concentrated on the cost of these goals. Current estimates range from $200 to $500 million. One alternative to burdening Vermont taxpayers with this important but expensive benefit is a federal solution.

President Biden has proposed a massive caregiving plan with up to $775 billion in investment to be paid for by changing tax regulations that mostly impact real estate developers. The Biden Administration proposal would:

- Provide free universal Pre-K for 3- – 4-year-old children

- Improve pay and benefits for child care workers

- Create a refundable tax credit up to $8,000 for low and middle class workers

- Provide subsidies for no more than 7% in income for anyone at 1.5x median income (the state goal in H.171 is 10%)

Earlier this week, the Biden Administration suggested that this bill would not see immediate action, mostly because some of the investments were included in the recently passed $1.9 trillion Relief Act which will increase the child tax credit up to a $3,600 per qualifying child. In a new twist, rather than taking this once a year as part of your annual tax filing, families will begin receiving periodic installments beginning in July.

Advocates and observers acknowledge that this expanded benefit will quickly become a popular program, making it difficult to let it expire. If Congress allows it to continue, it may go a long way to avoiding a Vermont-based tax increase for child care.

SHARE THIS ARTICLE

RECENT NEWS