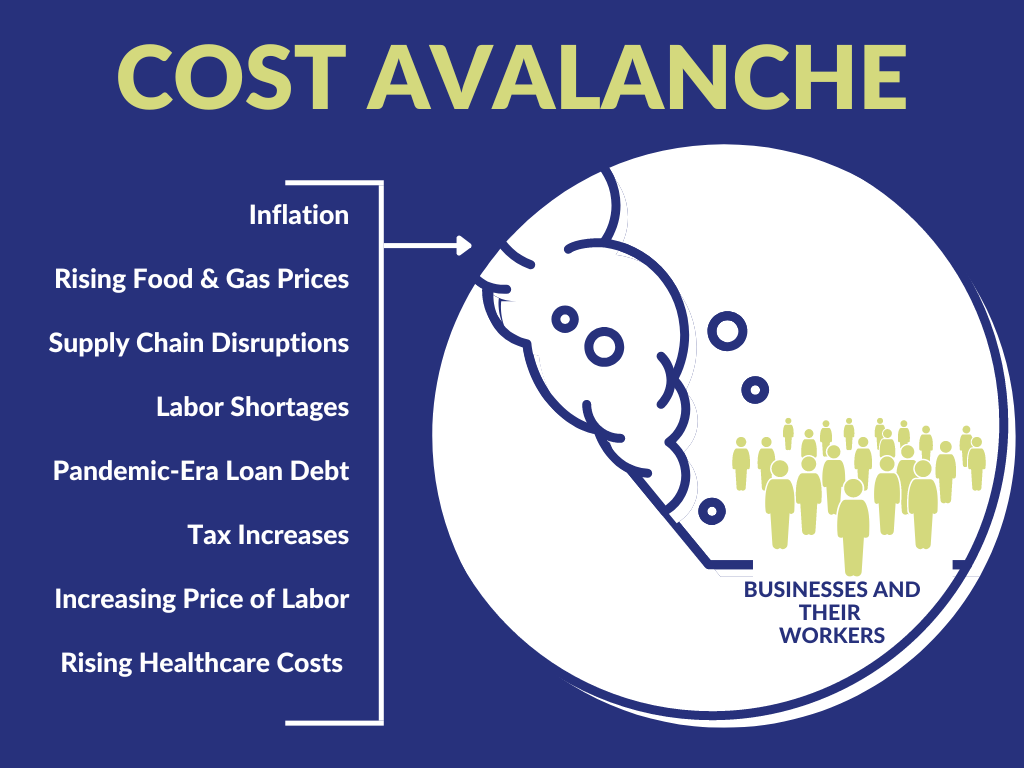

Accumulating Costs Add to Economic Uncertainty

Pressure on businesses has not eased since the pandemic lockdowns ended. Many industries are reporting more dire business conditions today than two years ago, and many businesses that weathered the pandemic are deeper in debt and less able to withstand the economic instability due to depleted reserves and ruined credit.

Right now, businesses are facing an avalanche of mounting costs. Inflation is at 9%, driving food prices up by a nationwide average of 13.1% in July. In Vermont, gas prices soared to a high of $5.61/gallon in June. This comes as businesses continue to struggle to source basic products amid ongoing supply chain issues. Labor costs in Vermont rose 15% during the pandemic, well above the nationwide average of 5%. In addition, Vermont health insurance rate hikes and hospital budget increases will put an even greater burden on those in the small group marketplace.

Policymakers must consider the accumulation of these costs on small businesses before raising taxes, passing new fees, or mandating costly and time-consuming compliance with new programs. Taken individually, a small payroll tax or a new registration fee for a growing industry may seem insignificant. However, businesses are still fighting to recover from the pandemic while also shouldering the mounting costs associated with inflation, soaring labor and healthcare costs, and a broken supply chain. Vermont has already seen stores closing, reduced restaurant hours, fewer options for childcare, fewer homes being built, and longer wait times to see a doctor or dentist. As the news of an impending recession continues, this could ultimately result in fewer jobs, less revenue to the state, and less vibrant communities. We need to ensure that we balance the desire to spend with the ability to pay.

SHARE THIS ARTICLE

RECENT NEWS