Having a vital and thriving manufacturing sector here in Vermont, as well as nationally, is essential to the overall health, growth, and future or our economy. Every $1 spent in manufactured goods generates an estimated $2.68 worth of additional economic activity, the third highest of any other economic sector. Additionally, each manufacturing job supports an five jobs elsewhere, according to the National Association of Manufacturers.

The Vermont Chamber is committed to advancing manufacturing because the significance of this industry is undeniable. We do this work through:

- Legislative advocacy on advancing the economy, workforce, housing, and tax policy focused on growth.

- Trusted member referrals and introductions.

- Adaptive supply chain matchmaking bringing buyers, suppliers, and partners together for contacts, new business opportunities, and contracts.

- Regional and international economic development.

With January’s economic data now in, we have a complicated picture for manufacturing as we head into March and look ahead. Inflation continues to accelerate and remains stubbornly high year-over-year. Both national and worldwide manufacturing activity continue to reflect contraction. Given the heightened geopolitical tensions with China and Russia, a pending debt ceiling crisis, and tight labor and housing markets, manufacturers remain resilient and must continue to navigate an economy that refuses to adhere to past norms.

In January, the Consumer Price Index (CPI) rose 0.5% to 6.4%, down from 6.5% in December, according to the U.S. Bureau of Labor Statistics. The personal consumption expenditure index, the Federal Reserve’s preferred price gauge, jumped 0.6% from December, a 5.4% increase year-over-year. The Producer Price Index (PPI), a measurement of what suppliers charge businesses and other customers, increased 0.7% in January, reversing a 0.2% decline in December, according to the U.S. Department of Labor. Producer prices for energy costs also spiked 5.0% in January.

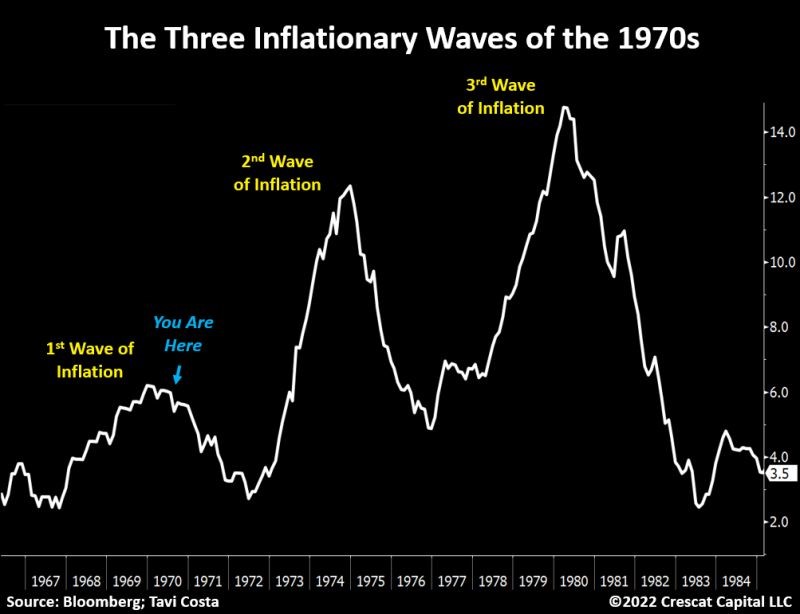

Inflation continues to remain high with price changes over the last year increasing for fuel oil (+27.7%), gas utilities (+26.7%), transportation (+14.7%), and electricity (+11/9%). Combined with 517,000 jobs added in January, a decline in jobless claims, a low 3.4% unemployment rate, and undaunted consumer spending, it can be expected that a resilient economy will push the Federal Reserve to further raise interest rates to curb inflation. The possibility of inflation waves, as the country experienced in the 1970s, is not unlikely given January’s data and several inflation drivers, such as the wage price spiral, higher material costs and costs of capital, and rising deglobalization trends. If rates were to head higher, this could tip the economy into recession for a hard landing and put millions of people out of work.

For the third straight month, national manufacturing activity declined to a post-pandemic low of 47.4 in January from 48.4 in December (anything below the 50 threshold reflects a shrinking economy) according to the ISM Manufacturing Purchasing Managers’ Index. Manufacturing activity slightly increased from 48.7 to 49.1, according to the J.P. Morgan Global Manufacturing PMI.

On a positive note, manufacturing production increased by 1.0% in January, representing a very modest 0.3% increase over the past 12 months. According to NAM, durable and nondurable goods output also rose 0.8% and 1.1%, respectively, and manufacturing capacity utilization rebounded from a 15-month low to 77.7% in January from 77.1% in December. Manufacturing employment rose 19,000 in January, with the manufacturing sector now employing 13 million people. Wages increased and average hourly earnings rose to $25.84 in January from $25.64 in December. With twice as many job openings as there are unemployed people, wage growth will continue to be an inflationary driver for the foreseeable future.

In the meantime, manufacturers are seeking creative ways to recruit workforce. According to the Wall Street Journal, “we are seeing a new development as manufacturers turn to former workers and retirees. Both tend to be efficient additions because they often need less training than new hires.” Until reforms are addressed, such as legal migration, we’ll continue to see creative but temporary fixes to deal with an estimated 800,000 job openings in manufacturing and what is ultimately a population challenge and aging demographics in areas of the country.

Finally, unless Congress and the White House raise the debt ceiling, the federal government could reach its debt in July and default on its debt obligations. The U.S. now has a staggering $31.4 trillion in total debt, which is on track to equal the annual output of the economy by 2024. If a compromise is not reached, both the U.S. and the world could face a financial crisis, a stock market crash, high unemployment, a crisis of confidence in the U.S. dollar as the world’s reserve currency, and a global recession.