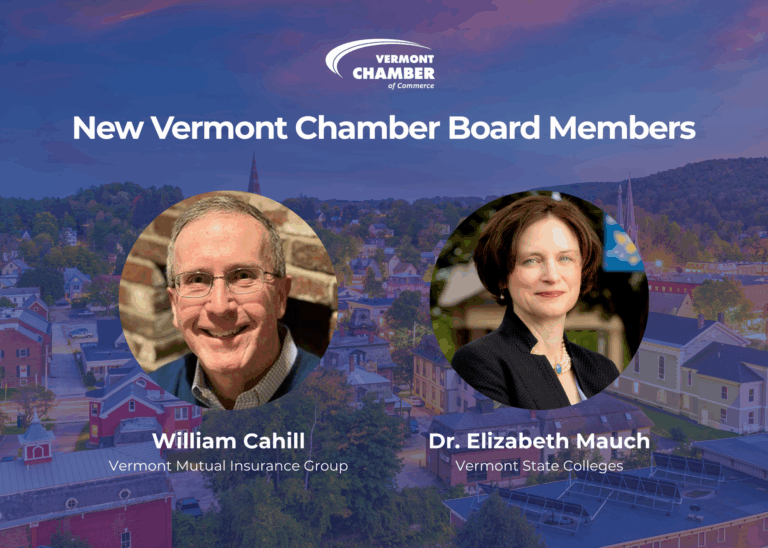

Vermont Chamber Announces New Board Members and Leadership

The Vermont Chamber of Commerce has welcomed two new Directors to the Board: William Cahill of Vermont Mutual Insurance Group and Dr. Elizabeth Mauch of Vermont State Colleges.

The Board also elected a new slate of officers, naming Sharon Rossi of FoodScience Corp. as Chair, Walter Frame of von Trapp Family Lodge & Resort as Vice Chair, Mike Hackett of Gallagher, Flynn & Company as Treasurer, and Thomas Dunn of VELCO as Past Chair. The Board also honored Pete McDougall of Paul, Frank + Collins for completing more than a decade of service, including a term as Chair. His leadership and commitment to the Vermont Chamber helped guide the organization through key milestones and strengthened its role as the state’s leading business advocate.

The Vermont Chamber Board of Directors is dedicated to shaping a more affordable, competitive, and abundant Vermont economy. Guided by the Chamber’s Strategic Plan, the Board brings together diverse business leaders whose lived experience ensures that our work is data-informed, inclusive, and reflective of the real challenges and opportunities facing Vermont’s economy.

“We are thrilled to welcome Bill and Beth to the Vermont Chamber Board of Directors. Their leadership and experience reflect the values of collaboration and innovation that define our work. As the state’s largest business advocacy organization, the Chamber relies on the insight and engagement of leaders from every sector. Bill and Beth will bring invaluable perspectives as we continue to shape policy, strengthen connections, and ensure Vermont remains a place where businesses of all sizes can thrive,” said Board Chair Sharon Rossi of FoodScience Corp.

Vermont Chamber President Amy Spear added, “The Vermont Chamber is proud to carry forward the responsibility of strengthening our state’s economy, a role made possible by the trust of Vermont’s business community. Our impact is the result of bold, collaborative leadership that reflects the diversity of industries across Vermont. We are honored to welcome these business leaders, whose expertise and vision will further strengthen our collective work to ensure a vibrant future for Vermont.”

The following business leaders will continue to serve as members of the board: Alberto Aguilar of Carris Reels, Inc., Mané Alves of Vermont Artisan Coffee & Tea Company, Sue Bette of Bluebird Hospitality, Brendon Blood of Blood’s Catering & Party Rentals, Hillary Burrows of Autumn Harp, Willie Docto of Moose Meadow Lodge & Treehouse, Kim Donahue of DeJames Hospitality, Renée Grzankowski of Vermont Economic Development Authority, Shireen Hart of Primmer Piper Eggleston & Cramer PC, Chris Karr of The Karr Group, Kelly Krayewsky of Windows & Doors By Brownell, Leslee MacKenzie of Coldwell Banker Hickok & Boardman, Nick Managan of Cabot Creamery, Roger Nishi of Waitsfield and Champlain Valley Telecom, Gary Scott of UVM Health Network, and Ian Sutherland of Acrisure.

SHARE THIS ARTICLE

RECENT NEWS